Wealth Accumulation, Preservation, and Transfer Planning

Welcome to Klaus LeFebvre & Wince LLP, a law practice devoted to assisting individuals and families looking for experienced, professional help in planning and managing complex legal and financial affairs.

The firm emphasizes wealth accumulation and transfer planning: estates, trusts, and taxes; agriculture; business organizations; probate; fiduciary law, and related litigation.

Specifically, the practice focuses on providing income, gift, and estate tax insights and recommendations to entrepreneurs, farmers and farm owners, high net worth families, executives, and licensed professionals with respect to wealth accumulation, preservation, and transfer planning opportunities.

Follow the links below for more detail on specific areas of practice.

Wealth Transfer Planning:

Family Lifetime Gifting

- Federal and Illinois Estate Tax Planning.

- Generation-Skipping Transfer Tax Avoidance/Planning.

- Insurance strategies (Commercial annuity, joint and survivor life insurance).

- Outright fractional interest gifts.

- Basic Trust Strategies (Family residence trusts; intentionally tax defective trusts, insurance trusts).

- Advanced Trust Strategies (grantor retained annuity and unitrust, charitable lead or charitable remainder trusts).

- Intra-family sale/leaseback or gift/leaseback, installment sale, self-canceling installment note.

- Reduced interest rate loan and third party guaranty.

- Private annuity.

- Joint or split property purchase.

- Remainder interest sale.

- Fractional interest real estate “sliver” gifts.

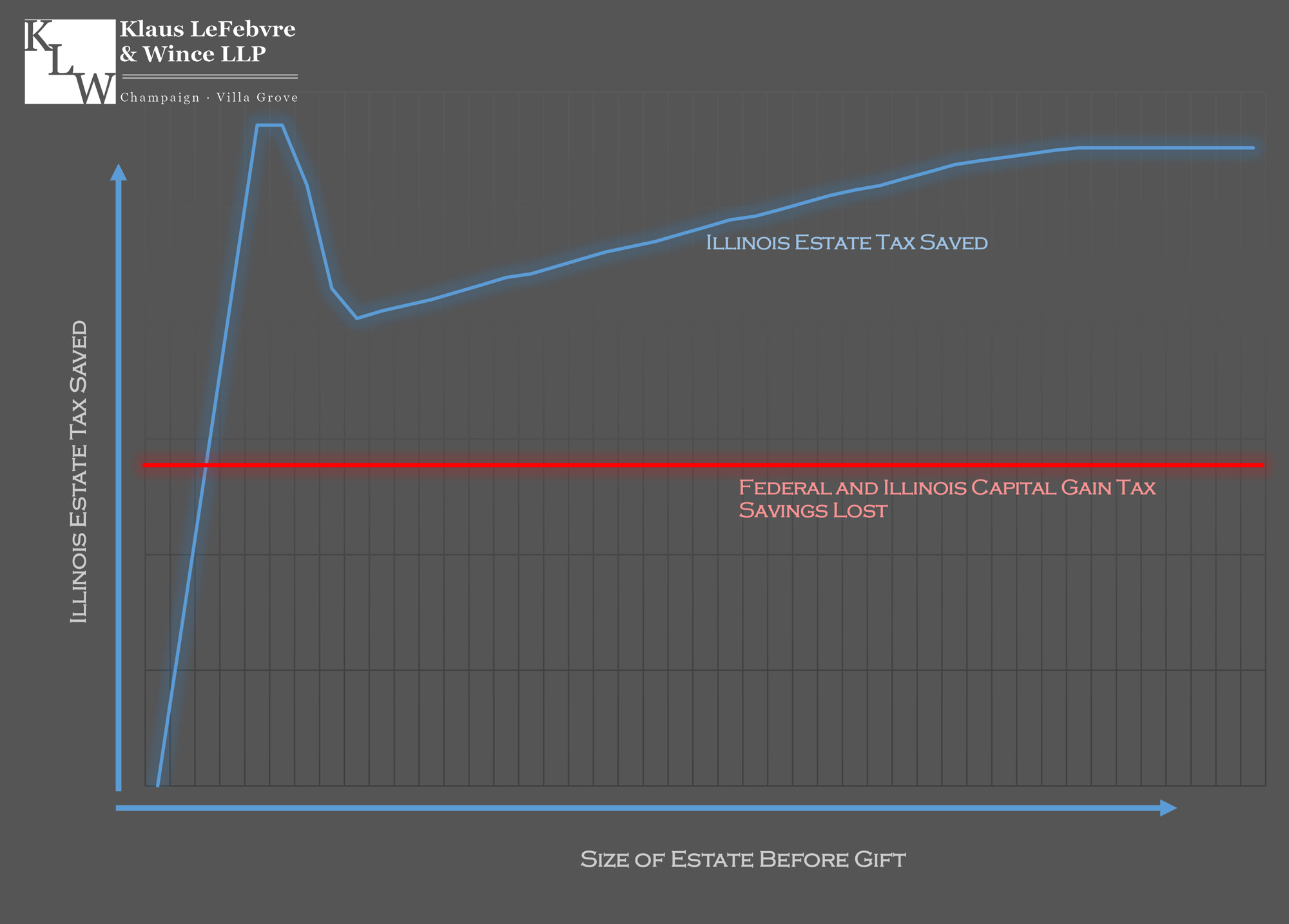

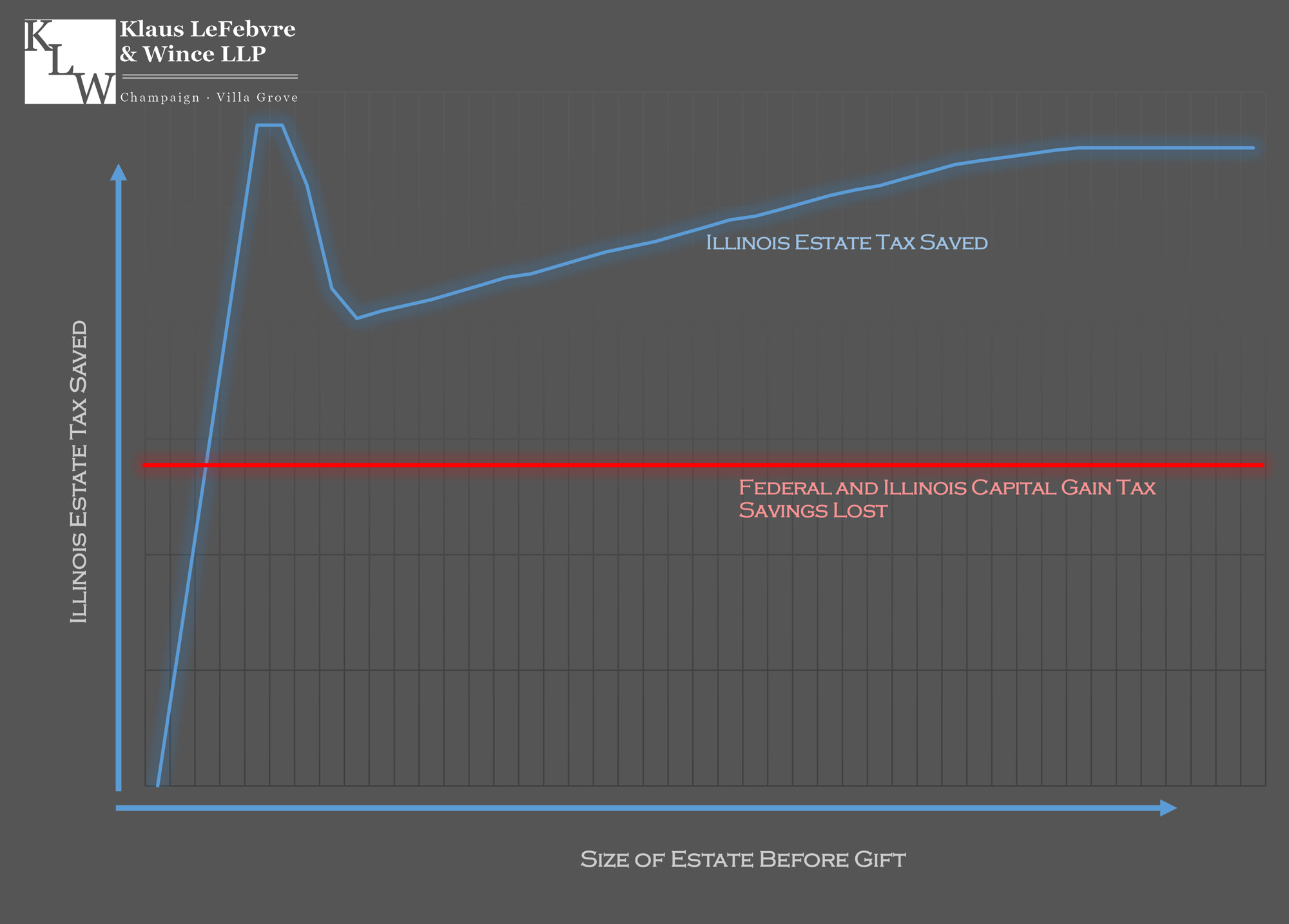

- Cost basis determination, comparison of lifetime vs. testamentary gifts, carry-over basis v. date-of-death or alternate valuation date increase in cost basis.

- Preparation and filing of gift tax returns.

Charitable Gifts

- IRA distributions to qualified charities.

- Bargain sale.

- Gift annuity, annuity and endowment contracts.

- Remainder interests in personal residence.

- Charitable partial interest transfers, charitable lead trust, charitable remainder trust, donor advised fund and private foundation.

- Family foundations and charitable trusts.

Probate Avoidance

- Payable on death arrangements, transfer on death instrument.

- Funding of revocable trust.

- Generation-skipping trust.

- Directed Illinois trust (administrative trustee, distribution advisor, investment advisor, special asset advisor and trust protector).

- Powers of Attorney for Property and Health Care and IRA/qualified plan distribution trust.

Post-Mortem Planning

- Administration process, income and estate tax elections.

- Renunciation, surviving spouse award.

- Full or partial disclaimers.

- Special-use valuation election for family farms.

- Deferred payment of tax for closely held businesses.

- QTIP/marital deduction elections.

- IRA distributions (potential second or third generation distributions, partial or full Roth IRA characterization).

- Estate liquidity options (corporate stock redemption, deferred tax payment plans, reversions and remainders).

- Valuation considerations (coordination of value of non-marketable assets, fractional interest, minority and marketability discounts).

- Cost basis step-up computations as to capital assets.

- Alternate valuation date.

- Use of portability in respect of basic exclusion amount.

- Preparation and filing of Federal and state estate tax returns and coordination with family accountant as to appropriate filings of Federal and state income tax returns.

- Illinois Estate Tax Planning.

- Insurance strategies (Commercial annuity, joint and survivor life insurance).

- Outright fractional interest gifts.

- Basic Trust Strategies (Family residence trusts; intentionally tax defective trusts, insurance trusts).

- Advanced Trust Strategies (grantor retained annuity and unitrust, charitable lead or charitable remainder trusts).

- Intra-family sale/leaseback or gift/leaseback, installment sale, self-canceling installment note.

- Reduced interest rate loan and third party guaranty.

- Private annuity.

- Joint or split property purchase.

- Remainder interest sale.

- Fractional interest real estate “sliver” gifts.

- Cost basis determination, comparison of lifetime vs. testamentary gifts, carry-over basis v. date-of-death or alternate valuation date increase in cost basis.

- Preparation and filing of gift tax returns.

Wealth Accumulation and Preservation Planning:

Business Organizations

- Various forms of close-held business organizations (S- and C- Corporations, Sole Proprietorships, General and Limited Partnerships, LLCs).

- Fragmentation of financial interests among business organizations.

- Intra-family sales and leasebacks, market rate intra-family loans, third party guarantees, financing arrangements.

- Combinations of business organizations, value deflection opportunities.

- Corporate governance.

- Business litigation.

Employee Benefits

- Qualified plan and IRA distribution rules and agreements.

- Non-qualified plans.

- Tax-qualified plans.

Note: we do not manage investments or serve as plan administrators.

Life Insurance

- Review product design, hidden costs, assessing guarantees, illustrations, guaranteed values vs. projected values.

- Evaluation of policy performance, present value of outlay, internal rate of return on cash value, internal rate of return at death.

- Use of insurance in transfer-tax planning (transfers of policies, "Crummy" Trusts, Revocable and Irrevocable Life Insurance Trusts).

Note: we do not sell life insurance or serve as agents on life insurance policies.

- Various forms of close-held business organizations (S- and C- Corporations, Sole Proprietorships, General and Limited Partnerships, LLCs).

- Fragmentation of financial interests among business organizations.

- Intra-family sales and leasebacks, market rate intra-family loans, third party guarantees, financing arrangements.

- Combinations of business organizations, value deflection opportunities.

We believe in the following principles of practice:

1

Communication

Communication.

Taking time to understand you. Making sure you understand our planning. Keeping you informed. Staying accessible with a commitment to same-day acknowledgement of client emails and other communications. Breaking down complex concepts into simple steps. Communication is the foundation of the trust clients place in their attorney. The entire process—from planning to billing—should be easy to understand.

2

Understanding the math

Understanding the math.

Many times no one runs numbers on an estate plan until after it is executed. Your attorney should understand the financial stakes before recommending a plan. We have developed our own software algorithims and methods which allow us to run complex calculations that strain the abilities of most planners. You will see, in concrete terms, how a proposed plan plays out before any document drafting begins.

3

This law practice is focused

This law practice is focused.

We coordinate with your investment advisors, accountants, insurance agents, professional fiduciaries, and other attorneys. Seamless traffic control of this team is part of the service.

Communication.

Taking time to understand you. Making sure you understand our planning. Keeping you informed. Staying accessible with a commitment to same-day acknowledgement of client emails and other communications. Breaking down complex concepts into simple steps. Communication is the foundation of the trust clients place in their attorney. The entire process—from planning to billing—should be easy to understand.

Partners

-

Richard P. Klaus

-

Rich Klaus, a native of central Illinois, has over thirty years of trial experience. As a trial lawyer and a trial judge, he has participated in taking over 200 jury trials to verdict. He has tried cases in both state and federal courts. He has also tried cases before the Illinois Court of Claims and the Illinois Department of Human Rights. Rich has successfully argued numerous appeals before the Illinois Appellate Court and the United States Court of Appeals for the Seventh Circuit.

Reported decisions of successful appeals include McNutt v. The Board of Trustees of the University of Illinois, 141 F. 3d 706 (7th Cir. 1998); Mitchell v. Donchin, 286 F.3d 447 (7th Cir. 2002); Brewer v. The Board of Trustees of the University of Illinois, 339 Ill.App.3d (4th Dist. 2003); Trejo v. Shoben, 319 F. 3d 878 (7th Cir. 2003).

Rich has litigated cases in a number of areas including employment, constitutional and civil rights, contract and commercial, real estate and construction, casualty and personal injury, legal and medical malpractice, tax, and trusts and probate.

In ten years as a judge of the Illinois Sixth Judicial Circuit, Rich presided over almost every type of case. He was appointed by the Illinois Supreme Court to serve on the Illinois Judicial Conference and the Juvenile Justice Committee. On that committee, he collaborated in writing and editing the reference books used by the state judges in juvenile cases.

Click here to send email

Richard P. Klaus' Education and Legal Experience:

Education

University of Illinois College of Commerce

Champaign, Illinois

B.A. Science in Finance, with High Honors, 1985

University of Illinois College of Law

Champaign, Illinois

J.D., Cum Laude, 1988

Prior Legal Experience

McDermott, Will & Emery, Chicago, Illinois

Litigation Associate

1988-1992

Flynn, Palmer & Tague, Champaign, Illinois

Associate and partner

1992-1998

Heyl, Royster, Voelker & Allen, Urbana, Illinois

Of counsel and partner

1998-2005

Associate Judge of the Sixth Judicial Circuit

2005-2015

Solo practice

2015-2018

Banner Ford Klaus LLP

2018-2020

Education

University of Illinois College of Commerce

Champaign, Illinois

B.A. Science in Finance, with High Honors, 1985

University of Illinois College of Law

Champaign, Illinois

J.D., Cum Laude, 1988

-

Charles A. LeFebvre

-

Chuck LeFebvre has many years of experience in trust & estate planning, as well as trust administration and working with family-owned businesses. He particularly enjoys working with families as they plan for and navigate through periods of transition, and he offers both a strong financial background and an appreciation of the law's protection of individual dignity and the realities of aging.

Far from a typical lawyer, Chuck emphasizes clear communication and client service, and he offers mathematical and analytical skills not often present in the legal profession. Chuck believes in the following principles of practice. (Click a box for more information.)

Click here to send email

Charles A. LeFebvre's Education and Legal Experience:

Education

University of Illinois

Champaign, Illinois

B.S. Mathematics, Highest Distinction, 1992.

See Details

G.P.A. 4.57 / 5.00

G.P.A. in Major 4.92 / 5.00

Edmund J. James Scholar, Academic Year 1989–90 (Recognizes extraordinary academic ability while participating in special curricular opportunities)

Dean's List, Academic year 1988–89 & Spring 1991

University of Illinois College of Law

Champaign, Illinois

J.D., Summa Cum Laude, Order of the Coif

See Details

G.P.A. 3.755 / 4.000, Class Rank 12 / 216

Law Review

Harno Fellow

Graduate School of Banking

University of Wisconsin, Madison 2013-2014

Cannon Financial Institute

Pepperdine University, Malibu, California

May 2009 Graduate of 3–year Trust School

See Details

Certified Trust & Financial Advisor (CTFA), May 2009–May 2014

Heckerling institute on Estate Planning

University of Miami School of Law

Orlando, Florida

Annual Institute Attendee since 2015

See Details

Continuing education on GRATs, SCINs, Split-Interest Trusts, Business Succession and Special Planning Techniques, Lifetime Asset Transfers, Intrafamily Alternatives to Gifts, etc.

Current Legal Experience

Klaus LeFebvre & Wince, LLP (Formerly LeFebvre Law Office)

Private Law Practice

Wealth Accumulation, Preservation, and Transfer Planning

Prior Legal Experience

First Mid-Illinois Bancshares, Inc (NASDAQ: FMBH)

First Mid-Illinois Bank & Trust, N.A. (now First Mid Bank & Trust, N.A.)

First Mid Insurance Group

Executive Vice President, 2007–2014

Chief Trust & Wealth Management Officer

See Details

Supervised corporate trust department, which provides trust administration, estate planning, estate administration, farm management, investment management, and brokerage services, approximately $1 billion in total assets. Served as general in-house counsel to CEO and executive team and various management committees. Served as parent company’s executive management overseeing subsidiary commercial insurance agency.

Thomas, Mamer & Haughey, LLP, Champaign, Illinois

Partner & Associate Attorney (2001–2007)

See Details

- Probate

- Trust Administration

- Estate Planning

- Elder Law

- Zoning and planning

- Business organizations

- General business litigation

- Real estate taxation

Justices Robert J. Steigmann and Frederick S. Green, Urbana, Illinois

Appellate Judicial Clerk (1998–2000)

See Details

Conducted legal research, drafted interoffice legal memoranda, and aided in drafting judicial opinions and orders.

Summer Associate (1997)

See Details

- ERISA

- Tax Litigation

- Agency / Fiduciary Relationships

- Employment Contracts

Education

University of Illinois

Champaign, Illinois

B.S. Mathematics, Highest Distinction, 1992.

See Details

G.P.A. 4.57 / 5.00

G.P.A. in Major 4.92 / 5.00

Edmund J. James Scholar, Academic Year 1989–90 (Recognizes extraordinary academic ability while participating in special curricular opportunities)

Dean's List, Academic year 1988–89 & Spring 1991

University of Illinois College of Law

Champaign, Illinois

J.D., Summa Cum Laude, Order of the Coif

See Details

G.P.A. 3.755 / 4.000, Class Rank 12 / 216

Law Review

Harno Fellow

Graduate School of Banking

University of Wisconsin, Madison 2013-2014

Cannon Financial Institute

Pepperdine University, Malibu, CA

May 2009 Graduate of 3–year Trust School

See Details

Certified Trust & Financial Advisor (CTFA), May 2009–May 2014

Heckerling institute on Estate Planning

University of Miami School of Law

Orlando, FL

2015, 2016, 2017, and 2018 Institute Attendee

See Details

Continuing education on GRATs, SCINs, Split-Interest Trusts, Business Succession and Special Planning Techniques, Lifetime Asset Transfers, Intrafamily Alternatives to Gifts, etc.

-

Hannah E. Wince

-

Hannah E. Wince has been practicing law since 2013. She graduated summa cum laude from Eastern Illinois University in 2010 and cum laude from the University of Illinois College of Law in 2013. A graduate of Villa Grove Schools and a rural Douglas County native, she returned to Villa Grove after completing law school. Having spent her entire life in the local farming community, Hannah has a deep understanding of the needs and concerns of the local ag community and is proud to be an important part of the Villa Grove community.

Hannah prides herself on always trying to find the most practical and straightforward solution to clients' legal issues. She is a member of the Illinois State Bar Association, the Douglas County Bar Association, the Champaign County Bar Association, and the East Central Illinois Women Attorneys Association. She lives in Villa Grove with her husband, David, their two children, and two very spoiled cats and a crazy dog.

Click here to send email

LinkedIn

Hannah E. Wince's Education and Legal Experience:

Education

Eastern Illinois University

Charleston, Illinois

B.A. English, Summa Cum Laude, 2010

University of Illinois College of Law

Champaign, Illinois

J.D., Cum Laude, 2013

Current Legal Experience

Wince Law Office, LLC

2013 - 2021

Private Law Practice, merged into Klaus LeFebvre & Wince LLP

See Details

Founded law firm in downtown Villa Grove with dedication to serving local community, business owners, farmers and farm families, and individuals. Areas of practice includes:

- Estate Planning

- Estate and Trust Administration

- Business Organizations

- Residential Real Estate

- Commercial and Farm Real Estate

- Drainage District Law

Prior Legal Experience

Law Office of John T. Phipps, P.C.

2011-2013

Law Clerk

See Details

Assisted in general law practice with a focus on family law, estate planning, and probate. Legal research, assistance with drafting, and trial preparation for complex divorce and probate matters. Assisted with preparation for appeal before the Illinois Appellate Court.

Education

Eastern Illinois University

Charleston, Illinois

B.A. English, Summa Cum Laude, 2010

University of Illinois College of Law

Champaign, Illinois

J.D., Cum Laude, 2013

Associate Attorneys

-

Erica D. Prosser

-

Erica D. Prosser joined Klaus LeFebvre & Wince in the fall of 2025. Her practice is highly focused on estate planning and tax law.

Erica obtained her undergraduate degree from Lehigh University, and her JD from the University of Illinois, College of Law, where she graduated cum laude. In law school, Erica interned for a federal district judge, and for the Illinois Innocence Project. She also served as the Career Development Chair for the Women's Law Society.

Prior to law school, Erica spent nearly a decade in Chicago's nonprofit sector, gaining hands-on experience in service, leadership and community engagement - values that are at the core of her client focused approach.

On a personal note, at Lehigh Erica participated in a highly competitive Division I women's basketball program, where she honed her discipline and determination, and learned how to perform under pressure and deliver results.

In her time off from the practice of law, Erica enjoys thrifting, cooking, and spending time with her partner exploring all the amenities Champaign-Urbana has to offer.

Click here to send email

Erica D. Prosser's Education and Legal Experience:

Education

Lehigh University

Bethlehem, Pennsylvania

Bachelor of Arts, High Honors, 2011

University of Illinois College of Law

Champaign, Illinois

J.D., Cum Laude, 2025

Legal Experience

Women's Law Society

Career Development Chair

2023 - 2024

Moot Court Board Member

2023 - 2024

Illinois Innocence Project

Student Attorney

2023 - 2025

U.S. District Court

Norther District of Illinois, Judicial Extern

2023

Education

Lehigh University

Bethlehem, Pennsylvania

Bachelor of Arts, High Honors, 2011

University of Illinois College of Law

Champaign, Illinois

J.D., Cum Laude, 2025

-

Eileen K. Resnick

-

Eileen K. Resnick is an alumnus of Southern Illinois University Simmons Law School. She is a recipient of the CALI Excellence for the Future Awards in both Evidence and Senior Writing, recognizing her academic excellence and commitment to the legal field. She worked throughout law school at Southern Illinois University Office of General Counsel handling a wide variety of litigation. Prior to law school, she graduated summa cum laude from Illinois State University in 2022 with her bachelor's in English. Originally from East Peoria, Eileen started her legal experience in family law and criminal law.

Eileen lives with her Aussiedoodle who loves to keep her in shape. In accord with her English degree, she enjoys reading and writing on the rare occasion she has free time.

Click here to send email

Eileen K. Resnick's Education and Legal Experience:

Education

Southern Illinois University Simmons Law School

Carbondale, Illinois

Southern Illinois University Simmons Law School

Illinois State University

Normal, Illinois

B.A. English, Summa Cum Laude, 2022

Legal Experience

McLean County State's Attorney's Office

Felony Intern

2022

Meyer Capel, P.C.

Legal Assistant in Family Law and Criminal Law

2022 - 2023

Southern Illinois University Office of General Counsel

Law Clerk

2023-2025

Education

Southern Illinois University Simmons Law School

Carbondale, Illinois

Southern Illinois University Simmons Law School

Illinois State University

Normal, Illinois

B.A. English, Summa Cum Laude, 2022